- WHAT IS FINANCE.COMPUTATIONS54

- WHAT YOU WILL GET

- WHY DO YOU NEED FINANCE.COMPUTATIONS54

- TECHNICAL DETAILS

- EXAMPLES OF OUR STRATEGIES

WHAT IS FINANCE.COMPUTATIONS54

Finance.Computations54 is an adaptation of the framework for robust computing Computations54 for building exchange strategies. It can be used:

- in advisor mode for brokers for investment tips

- to create and test exchange strategies based on historical results (backtest)

- to check the operation of strategies in the paper trading mode

- to launch strategies on real trading

WHAT YOU WILL GET

With the help of Finance.Computations54 and our team you can:

- develop your own strategies for exchange trading

- check and test strategies through backtesting and paper trading

- optimize trading strategies

- adapt strategies for online trading

- predict the behavior of markets or indices

- build your own indexes

WHY DO YOU NEED FINANCE.COMPUTATIONS54

In developing Finance.Computations54, we have gone through many years of creating an efficient and reliable computing framework and its accompanying infrastructure.

Finance.Computations54 provides the following features:

- quick creation of a strategy for testing both on historical data and in paper trading mode

- creating a strategy for live trading

- ready connection to Interactive Brokers broker

- quick addition of any other brokers

- gaining access to historical databases of Norgate, Sharadar, including crypto assets

- quick adaptation of strategies for cryptocurrency trading

- access to ready-made strategies

- support of a team of highly qualified engineers with a financial background

TECHNICAL DETAILS

Financial and other derivative factors, work with which is integrated into Finance.Computation54:

- Open- price at market opening (per day/week/month).

- High- the highest price for the period (per day/week/month).

- Low- the lowest price for the period (per day/week/month).

- Close - market closing price (per day/week/month).

- Volume - number of purchase and sale transactions (per day/week/month).

- Turnover - cash turnover (per day/week/month).

- Return(daily/weekly/monthly) - percentage ratio of prices at the end and beginning of the period. Shows how the price has changed over the period: a negative return indicates a fall in price, a positive return indicates an increase.

Let at the beginning of the period the price was 65.31, and at the end of the period it decreased to 63.1, then return = 100 * (63.1 - 65.31) / 65.31 = -3.38%, this means that the price fell by 3.38% compared to the beginning of the period. - MomentumScore (daily/monthly) - arithmetic average of returns for periods of different durations. Shows the average price change over different periods.

For example, if the return for 1 month is 7%, for 3 months - 17%, for 6 months - 15%, and for 12 months - 30%, then momentum score = (7+17+15+30)/4=17.25 %. The higher the MomentumScore, the greater the profit the asset can provide. - RSI(daily/weekly) - allows you to assess overbought and oversold conditions. Takes a value from 0 to 100. If the price rises rapidly over a short period, then it is most likely that it will fall soon - this condition is called overbought. It is usually said that the price is in the overbought zone when the RSI > 80. Conversely, when the price falls rapidly over a short period, it will most likely begin to rise in the near future - this condition is called oversold.

- Connor's RSI (CRSI) - allows you to evaluate overbought and oversold conditions. It takes a value from 0 to 100. Unlike RSI, this indicator gives signals earlier. It is recommended to use it with other indicators, as it can sometimes give false signals.

- Liquidity is an indicator characterizing the ability to quickly sell an asset at a market price. The greater the liquidity, the faster you can sell the asset.

- Volatility is the fluctuation in asset prices on the market. If volatility is low, then the market is at rest and price fluctuations are moderate. High volatility indicates sharp and stronger price jumps. With high volatility, you can get more profit, but there are also more risks. On the chart, the level of fluctuations displays the size of the candles.

- Standard deviation (STD)- shows the average deviation of the price from its average value for the period under consideration. Helps assess the volatility and risks of an asset.

The calculation of volatility and STD is identical. Our difference is that volatility by default is considered to be 100 days, and STD is calculated to be 65 (~3 months), although these parameters can be changed. - Market capitalization is the market value of the company. Small-cap companies have greater growth potential, but are also risky. Companies with larger capitalization are more reliable and fall more slowly during a crisis.

- Dividend yield (DY) - the ratio of the dividend value (part of the profit returned to the shareholder for holding the share) to the share price. It is used for comparative evaluation of shares of various companies for maximum dividend income.

- Industry - shows which industry sector the company belongs to. Can be used to select assets with the greatest diversity of sectors. Possible sectors: Real Estate, Healthcare, Basic Materials, Energy, Industrials, Consumer Cyclical, Utilities, Consumer Defensive, Technology, Financial Services, Communication Services.

- PriceDayChange (internal factor Finance54) - percentage change in different types of prices (high, low, close, open) within one day.

For example, if open=62.7 and high=63.2, then the percentage change in high compared to open will be 100 * (63.2 - 62.7) / 62.7 = 0.8%. - PreviousDayPriceChange (internal factor Finance54) - percentage change in different types of prices (high, low, close, open) on one day compared to the previous day (similar to the previous one, only prices are taken for two adjacent days).

- Simple moving average (SMA) - the arithmetic average of prices over a certain period. SMA allows you to evaluate the direction of the trend: if the current price is higher than the SMA, then the trend is going up, otherwise - down.

- SMAV(internal factor Finance54) - the arithmetic mean of the products close * volume for a certain period. Estimates the average value of cash turnover.

- WeekHigh(internal factor Finance54) - determines the week with the highest high price (and the price itself) for the required period.

- RecentWeekHigh (Finance54 internal factor) - shows how many days ago the highest price was observed for the period specified in weeks.

Optional factors:

- Strike - option exercise price.

- Last - the last value of the option (can even relate to the previous day).

- Bid - bid price.

- Ask - offer price.

- Volume - trading volume (number of contracts).

- Delta - the change in the option price when the price of the underlying asset changes. The delta of call options ranges from 0 to 1, and that of put options from 0 to -1. In practical terms, if the delta of a call option is 0.35 and the price of the asset increases (decreases) by $1, then you can expect the value of the option to increase (decrease) by 35 cents. If the delta of a put option is -0.7 and the price of the asset increases (decreases) by $1, then we can expect the option value to decrease (increase) by 70 cents.

- Implied volatility rank (IVR) - estimates how high or low the current implied volatility (IV) is compared to the implied volatility level over the past year (52 weeks). If, for example, the current IV is 34.5%, the minimum for the year = 17%, and the maximum is 37%, then IVR = (34.5-17)/(37-17)*100=87.5%. This means that current implied volatility is quite high, which will cause the option price to be high, which will benefit option sellers.

EXAMPLES OF OUR STRATEGIES

Several publicly available strategies are fundamentally integrated into the Finance.Computations54 calculation system.

Examples of calculating basic strategies from the book Alpha Formula using Finance.Computations54:

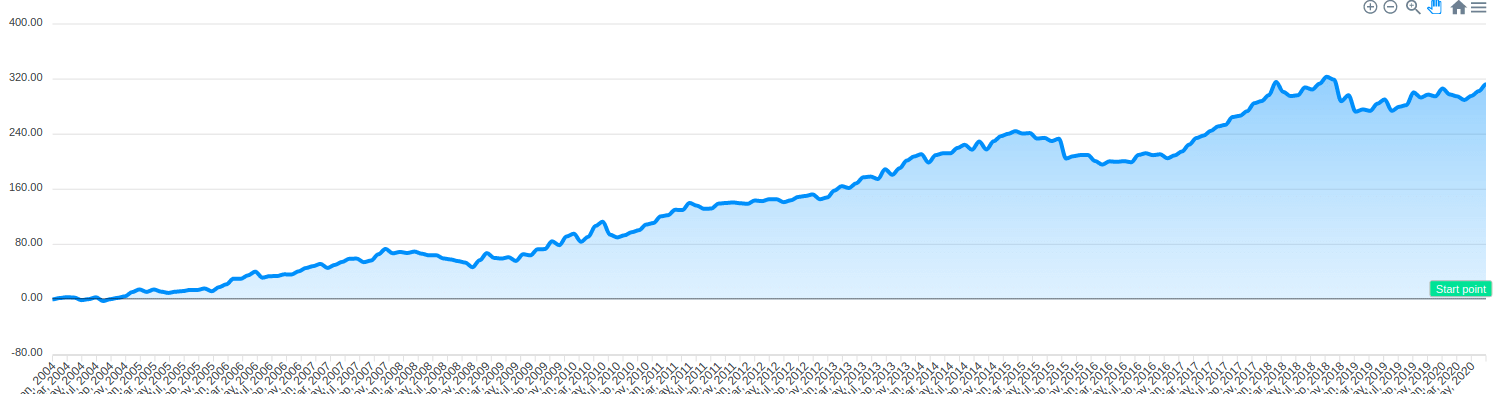

- CONSERVATIVE STRATEGY IN GROWING MARKETS

Entry rules:

Momentum months: 1, 3, 6, 12

Portfolio Limit: 5

Max year drawdown: -11.59%

Total: 312.37%

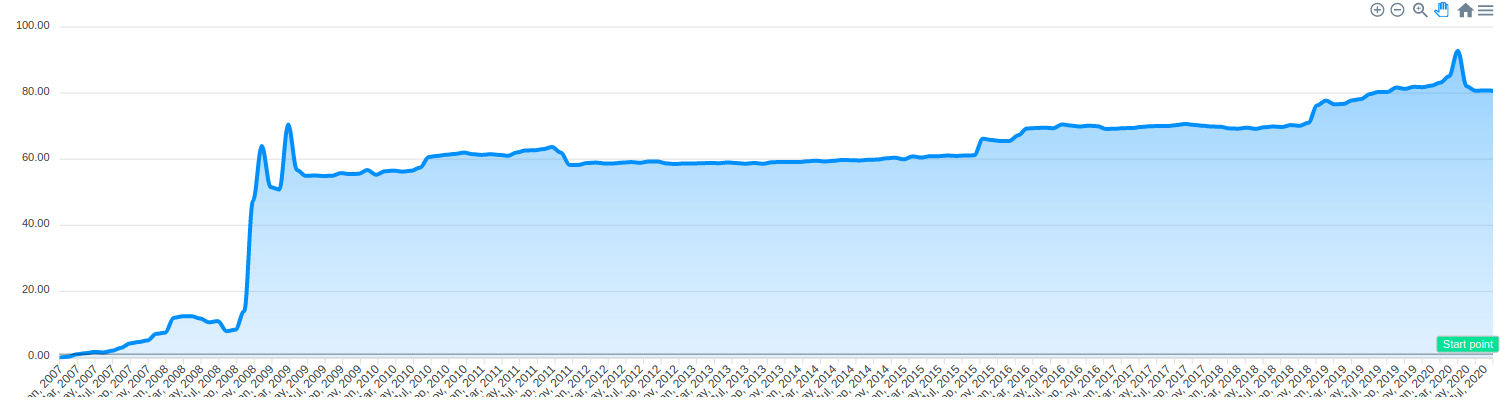

- CONSERVATIVE STRATEGY IN FALLING MARKETS

Input parameters used for strategy run from 2007-01-01 to 2020-07-01

Entry rules:

Long-term trailing return is negative, days used: 252

Intermediate-term return is negative, days used: 21

2-period RSI is above: 70

Exit rules:

2-period RSI is below: 15

Intermediate return turns positive, days used: 21

Max year drawdown: -1.520%

Total: 80.73%

Also read:

- Computations54 - Platform for mission-critical computing and data processing

- Flameshot - screenshot tool for linux